Kofola achieved its annual targets. Fresh and herbal drinks contributed to the success in a difficult economic year

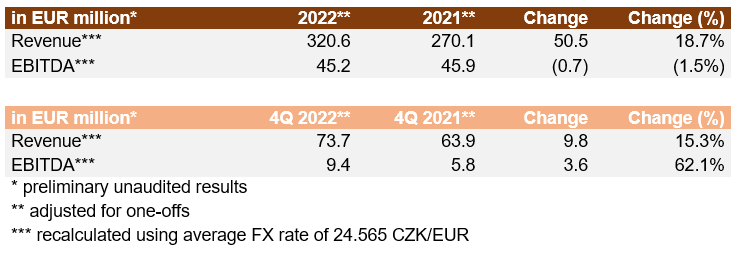

Despite increased energy and raw material costs, Kofola Group achieved an EBITDA operating profit of EUR 45.2 million. This was driven by growing sales in key channels, a record summer season, year-on-year growth in the on-the-go category, and the growing popularity of fresh juices and herbal teas. Kofola has thus confirmed its role as a major domestic producer that is able to achieve stable results thanks to effective management.

The year 2022 was marked by an energy crisis. The rise in energy prices, as well as in PET material and sweeteners, meant additional costs for the Kofola Group of approximately

EUR 20 million compared to the previous year.

"Inflation and rising costs in all of our major cost categories - from materials, energy, transport, personnel, and service costs - have caused high price pressures, which we have had to offset by seeking further savings and gradually increasing our selling prices," comments Jannis Samaras, CEO of Kofola Group. "I am pleased that, thanks to our flexible

decision-making, efficient management, and excellent sales performance, we have managed to exceed our last announced annual EBITDA target. But although the results appear very good, it must be said that three years ago we thought we would be much further ahead today. The reality of recent years has influenced our strategic plans," Samaras adds.

In the key Czechoslovak region sales grew in all beverage formats. Drinks for home consumption increased by 9%. In gastro, where Kofola serves more than 17,000 customers, sales increased by 51% compared to last year. “Draught Kofola dominated the summer season. Packaged beverages, especially on-the-go formats, also did well, with sales up

25% year-on-year. Despite the surprisingly positive revenues, EBITDA of the beverage segment in Czechoslovakia declined due to increased inputs," says Daniel Buryš, CEO of Kofola in Czechoslovakia.

Other Group's segments were also successful. Although there were a lot of challenges with inflation and rising costs, Adriatic segment grew in Slovenia and Croatia. The sales in both countries exceeded 2019, volume wise (in liters) increased year-on-year by 8% and export experienced double digit growth.

Kofola's fragrant pillar, LEROS, which produces and distributes tea and coffee, is also on an excellent trajectory after last year. "Year-on-year, we are growing in all major channels - from pharma to gastro to retail. We are very pleased with our e-commerce, which is now an integral part of our business and thanks to which we are also developing herbal cosmetics, for example," says Martin Mateáš, CEO of LEROS.

UGO, which offers consumers a range of healthy foods, also showed a significant improvement in EBITDA last year, confirming the growth potential of this segment. "We have optimised our processes and implemented a number of cost-saving measures on our Salaterias (from the use of energy-saving light bulbs and smart sensors to the installation of water pearlers). Attractive new products in our QSR range and our growing packaged portfolio also contributed to sales up 58% year-on-year," says Marek Farník, CEO of UGO.

Another positive fact about Kofola's overall performance is that the Group managed to reduce its net debt to EBITDA ratio to below 3 through a combination of good results and cost-saving measures.

Thanks to the successful end to a difficult year, Kofola was also able to support another local sustainable project. Within the framework of the Incubator, in which the company develops innovative start-ups, Kofola provided a loan for the development of the Krnov-based company Zahradní OLLA. It produces eponymous clay pots designed for gentle irrigation of plants. Kofola also made an important step towards the conservation of water resources - launching the non-profit organisation Kvapka Rajeckej doliny, whose main focus is the implementation of water conservation projects.

The Kofola Group enters 2023 with a promise to achieve a total EBITDA target of

EUR 44.8 - 50.9 million. Significant product innovations, such as Rajec Tea Ice Herb,

SEMTEX Extrem (an energy drink without taurine, and with guarana and matcha),

Targa Florio Tonic or Prager´s KOMBUCHA (a fermented tea drink with probiotic cultures) from F.H. Prager, could contribute to this.